Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The 7216 form refers to Form 7216, "Consent to Disclosure of Tax Return Information," which is used by taxpayers to authorize tax professionals (such as CPAs or enrolled agents) to disclose their tax return information to third parties. This form is used to comply with the Internal Revenue Service (IRS) regulations regarding the confidentiality of tax return information.

Who is required to file 7216 form?

The 7216 form, also known as the "Consent to Use and Disclosure of Tax Return Information," is required to be filed by tax return preparers and individuals or businesses that obtain tax return information for a legitimate purpose. It is a consent form that authorizes the disclosure of a taxpayer's confidential tax information to third parties.

How to fill out 7216 form?

The 7216 form is a consent form required by the Internal Revenue Service (IRS) in the United States. It is used when a tax preparer or tax software provider needs to disclose a taxpayer's information to a third party.

Filling out the 7216 form requires specific steps to ensure compliance with IRS regulations:

1. Obtain the correct form: The 7216 form can be obtained from the IRS website (www.irs.gov) or from your tax software provider if you use tax software to prepare your taxes.

2. Identify the taxpayer and third party: Fill in the taxpayer's information, including name, address, Social Security number (or taxpayer identification number), and the tax year in question. Also, provide the name and address of the third party who will receive the taxpayer's information.

3. Select disclosure options: The form provides various choices regarding the types of information that will be disclosed. Tick the appropriate boxes that indicate the specific information to be shared with the third party. Ensure you only select the necessary boxes to avoid unnecessary disclosure of sensitive information.

4. Specify consent duration: Indicate the period for which the consent is valid. The taxpayer can choose to give consent for a single use or for a specific period, such as the current tax year or multiple years. Ensure the duration is clear on the form.

5. Additional authorization: If there are specific purposes for which the taxpayer's information will be used by the third party, provide any necessary authorization or description of those purposes. This may include things like tax preparation, financial planning, or legal representation.

6. Taxpayer and preparer signatures: Both the taxpayer and the tax preparer (if applicable) must sign and date the form to validate the consent. Unsigned forms will not be considered valid.

7. Retain a copy: Make sure to keep a copy of the filled-out and signed form for your records. It is advisable to retain records for at least three years.

Remember, the completion of Form 7216 does not relieve the tax preparer or software provider from maintaining the confidentiality of the taxpayer's information. They are still required to safeguard the data as per IRS regulations.

As the information provided above is a general guide, it is recommended to consult with a tax professional or review the IRS instructions for the specific requirements and guidelines while filling out the 7216 form.

What is the purpose of 7216 form?

Form 7216, titled "Consent to Disclosure of Tax Return Information," is used by tax professionals to obtain consent from their clients before they may disclose their tax return information to a third party. This form is required by the Internal Revenue Service (IRS) and helps protect taxpayer privacy by ensuring that their tax information is shared only with authorized individuals or organizations. The purpose of Form 7216 is to obtain the necessary consent while maintaining the confidentiality of a taxpayer's personal financial details.

What information must be reported on 7216 form?

Form 7216, also known as the "Taxpayer Consent to Disclosure of Tax Return Information," is used by tax return preparers to obtain the consent of their clients before disclosing or using their tax return information for purposes other than preparing and filing their tax returns.

The form requires several key pieces of information to be reported, including:

1. Taxpayer Information: The name, address, social security number (or taxpayer identification number), and contact information of the taxpayer(s) whose consent is being obtained.

2. Tax Return Preparer Information: The name, address, and contact information of the tax return preparer who is requesting the consent.

3. Scope of Consent: A description of the specific purpose for which the tax return information will be used or disclosed. This could include purposes like providing financial planning advice, obtaining financing or credit, or responding to an audit or inquiry from a taxing authority.

4. Disclosure Recipients: The name, address, and contact information of any third parties who will receive the tax return information. This could include organizations, individuals, or other entities to whom the tax return preparer intends to disclose the information.

5. Duration of Consent: The period of time during which the taxpayer's consent is valid. This can be specified as a specific date or an event that triggers the expiration of the consent.

6. Signature and Date: The taxpayer must sign and date the form to indicate their consent.

It is important to note that tax return preparers should provide all necessary disclosures and obtain written consent from the taxpayer(s) before using or disclosing their tax return information for any purpose not specifically authorized by the Internal Revenue Service (IRS). Failure to comply with these requirements can lead to penalties and other legal consequences.

When is the deadline to file 7216 form in 2023?

The deadline to file Form 7216 in 2023 would typically be April 18th, which is the general tax filing deadline for most individuals and businesses. However, it's always advisable to double-check with the IRS or a tax professional for any specific updates or changes to the deadline.

What is the penalty for the late filing of 7216 form?

The penalty for the late filing of Form 7216 varies depending on the circumstances. Generally, if a tax return preparer fails to timely file Form 7216, they may be subject to a penalty of $250 for each violation.

However, if the violation is due to intentional disregard, the penalty can be increased to $1,000 per violation. Additionally, criminal penalties may apply for willful violations, including potential imprisonment.

It's important to consult with a tax professional or review the specific instructions and guidelines provided by the IRS for accurate and up-to-date information on penalties associated with late filing of Form 7216.

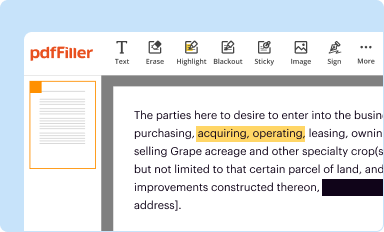

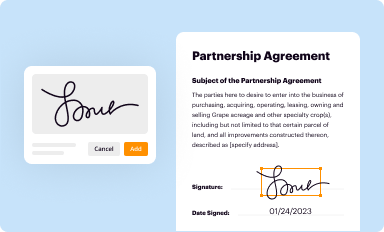

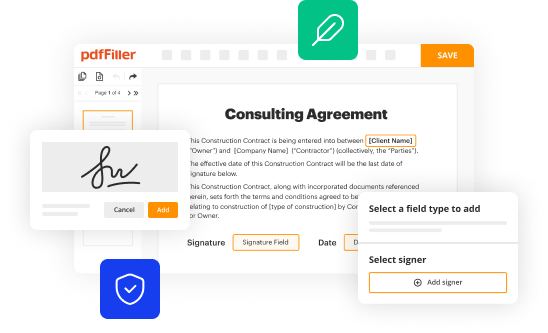

How can I modify form 7216 download without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your taxpayer consent form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find 7216 form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific taxpayer consent form and other forms. Find the template you need and change it using powerful tools.

How do I complete taxpayer consent form pdf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 7216 consent form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.